Nov 21, 2022

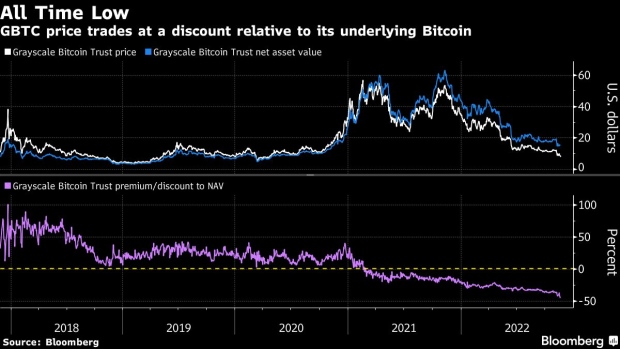

Biggest Bitcoin Fund Hits 45% Discount as Parent’s Woes Deepen

, Bloomberg News

(Bloomberg) -- Cascading crypto blowups have only exacerbated problems for Grayscale’s $10.5 billion Bitcoin fund.

The Grayscale Bitcoin Trust (ticker GBTC) closed a record 45% below the value of its underlying coins on Friday, according to Bloomberg data. The shares fell another 5% on Monday. The dislocation has widened dramatically in recent weeks as GBTC -- which can’t redeem shares to shift with cooling demand as traditional ETFs do -- has fallen to a greater degree than Bitcoin itself.

Shares are being offloaded in the secondary market as the industry deals with shockwaves from crypto-exchange FTX’s bankruptcy this month. That sent the likes of Genesis into a tailspin, with the lender halting withdrawals last week -- fueling questions about the health of its parent company, Digital Currency Group, which also controls digital-asset manager Grayscale Investments. Fears of fallout among already shellshocked investors likely explains why GBTC is selling off to a greater degree than Bitcoin itself, according to Bloomberg Intelligence.

“There is a lot of concern and news reports and rumors about DCG, the parent of Grayscale,” Bloomberg Intelligence analyst James Seyffart said. “I think people just want to get away from anything that could be coming down, even if it’s only a remote possibility.”

A Grayscale representative didn’t immediately return an email for comment.

GBTC’s share price has plunged 77% in 2022, compared with Bitcoin’s 65% fall. While GBTC has soared 1,000% since the end of 2015, the world’s largest cryptocurrency has surged more than 3,600% in that time frame.

Bloomberg Intelligence estimates that GBTC holds more than 3% of all mined Bitcoin, which is custodied with Coinbase Global. On Friday, Grayscale shared a letter from Coinbase Chief Financial Officer Alesia Haas saying that the trust’s coins are in cold storage and can’t be lent out.

Grayscale has few options for narrowing the discount beyond converting into a physical Bitcoin exchange-traded fund, a structure that US regulators have repeatedly denied. It’s unlikely that the firm would opt to liquidate GBTC given that the product generates a hefty annual recurring revenue through its fees, according to a Bloomberg Intelligence report. Additionally, there’s no longer an option for shareholders to force a liquidation through a proxy vote, the report said.

--With assistance from Vildana Hajric.

©2022 Bloomberg L.P.