Oct 17, 2022

Bank of Canada sees worst drop in business outlook since 2020

, Bloomberg News

BoC seeing worst drop in business sentiment since 2020 in line with global level: Dominique Lapointe

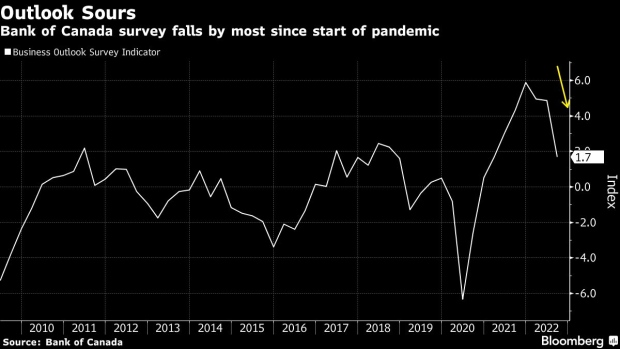

Sentiment among Canadian firms fell the most since the beginning of the pandemic, with inflation expectations among consumers and businesses showing few signs of abating, Bank of Canada surveys show.

The central bank’s business outlook indicator fell to 1.69 in the third quarter, from 4.87 previously. While still positive, that’s the largest deterioration in the confidence of Canadian firms since the second quarter of 2020.

“Many firms expect slower sales growth as interest rates rise and demand growth shifts closer to pre-pandemic levels,” policymakers said Monday in the quarterly business outlook survey. Respondents noted that while they see their input and output prices easing, expectations of overall inflation remain elevated. More than three quarters of firms say inflation will stay higher than 3 per cent, the top of the central bank’s control band.

Bonds staged a modest rally after the release of the data, with the yield on benchmark Canadian two-year debt falling about two basis points to 4.098 per cent as of 10:43 a.m. Ottawa time. The loonie was little changed.

Consumer expectations for short-term inflation hit a fresh record in a separate survey.

The data highlight a rapid erosion of business conditions, brought on by a combination of a slowing economic momentum, high inflation, and the central bank’s increases to borrowing costs. The combination of slower growth and higher inflationary pressures may complicate the bank’s policy response, and decrease the likelihood of achieving a so-called soft landing.

Most businesses and consumers think a recession is likely within the next 12 months, triggered by large increases in interest rates and high prices that reduces consumption. The two groups also see inflation remaining elevated over the next one or two years before returning to the central bank’s target in the long term.

While both have similar inflation expectations and views on the probability of a recession, they diverge on wages.

The average expected wage increase among businesses has receded, with nearly half not seeing abnormally high wage growth beyond the next 12 months. But consumer expectations for wage growth have increased, with 40 per cent of workers now seeing pay gains of more than 4 per cent over the next year.

With firms expecting demand to slow and resisting large wage increases, consumers said their wages weren’t keeping up with inflation and believed they wouldn’t catch up, resulting in spending cuts and changes in shopping habits. Consumers also see shrinking real wages as the main trigger of a recession.

Most firms said rate hikes aren’t yet holding back their investment plans. But fewer businesses are planning to hire, and some in information technology, engineering and trades are constrained by supply of skilled workers.

The Bank of Canada’s next decision is Oct. 26, where policymakers are expected to raise interest rates by at least 50 basis points, according to market pricing. The benchmark overnight rate is currently 3.25 per cent, up three percentage points since March.