Oct 6, 2022

AQR Trend-Following Strategies Return as Much as 70% in Big Year

, Bloomberg News

(Bloomberg) -- AQR Capital Management’s trend-following strategies are notching big gains this year as quants across the industry surf relentless inflation-driven price trends in almost every asset class.

The Connecticut-based firm’s Managed Futures Full Volatility Strategy -- which represents about $1 billion in assets -- handed investors more than 9% last month, taking its returns this year to 70%, according to AQR. At the same time, the $450 million Alternative Trend Strategy has delivered 47% in 2022, it said.

These strategies are deployed across a number of AQR vehicles that use derivatives to follow price trends in everything from stocks and bonds to commodities and credit-default swaps.

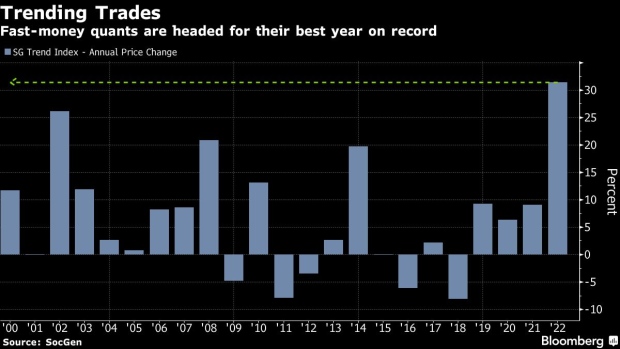

It’s a breed of rules-based investing that is thriving in 2022 after the fallout from rampant inflation triggered prolonged moves across assets. While trend followers come in all shapes and sizes and their returns vary across the industry, a broad index from Societe Generale SA tracking the cohort is up 31%, headed for the best year on record.

Meanwhile, AQR’s main mutual fund following the investing style has returned about 38% this year, according to data compiled by Bloomberg.

“If macroeconomic volatility stays high and asset classes continue to show big moves in the same direction, we expect to see continued high returns for these strategies,” Yao Hua Ooi, principal at AQR, said in an interview.

The firm’s Full Volatility strategy -- which mainly bets on trends in stocks, bonds, raw materials and currencies -- has been boosted by its fixed-income shorts, as well as long-commodity wagers earlier in the year and long-dollar positions more recently.

AQR also tweaked the strategy to include a 20% risk-adjusted allocation to alternative assets at the start of 2022, Ooi said. Plus it increased the importance of macro economic trends, including in things like inflation and monetary policy.

“We didn’t make these changes because we knew 2022 was going to be such a volatile year,” said Ooi. “The goal was to have better long-term returns and also better performance during equity drawdowns.”

The Alternative Trend Strategy focuses on less-liquid and more complex products including interest rate swaps, CDS, and exotic commodity futures contracts among others. Some of the big wins for this investing style in 2022 have come from long bets on Italian, German and French power markets.

It’s all a potential vindication for trend followers who, broadly speaking, have struggled for much of the past decade. That extended underperformance was mostly attributed to muted asset swings amid loose monetary conditions, with some skeptics also blaming crowded trades.

Read more: Computer-Driven Hedge Funds Surge Ahead Amid Chaotic Markets

The fastest monetary-tightening campaign in years has been driving the dollar ever higher and bonds lower, while fueling a commodity supercycle earlier in the year. All that means one-way price moves have endowed trend followers with outsize gains across the industry.

“If things reverse course or start to move in smaller ways, then perhaps the pace of these gains will slow down,” said Ooi.

©2022 Bloomberg L.P.