Mar 28, 2023

Alibaba’s $32 Billion Day Signals Breakups Ahead for China Tech

, Bloomberg News

(Bloomberg) -- Alibaba Group Holding Ltd.’s overhaul could serve as a template for a restructuring of China Tech itself: a shake-up that achieves Beijing’s aim of carving up the country’s tech titans while unlocking potentially billions of dollars in pent-up shareholder value.

China’s online commerce leader surprised markets by announcing Tuesday plans to split its $220 billion empire into six units that will individually raise funds and explore initial public offerings. In executing the biggest overhaul in its history, Alibaba manages to address two objectives that have eluded many of its rivals — appeasing both a government distrustful of Big Tech and investors traumatized by a years-long regulatory crackdown.

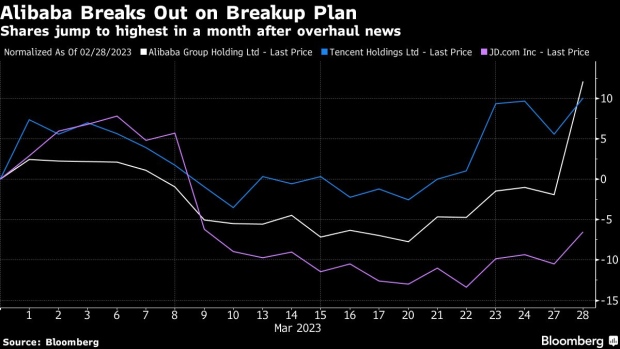

Its shares soared over 16% in Hong Kong, a tad more than it managed in New York, adding more than $30 billion to its market value. Rivals including Tencent Holdings Ltd. also surged, on anticipation that Alibaba’s peers might explore similar actions in a loosened regulatory regime.

The shift to a holding company structure is rare for major Chinese tech firms and could present a template for peers such as WeChat operator Tencent. Xi Jinping’s administration had long criticized the influence of online platforms, worried that concentrating power and data among a few tech companies suppresses innovation and threatens the Party’s grip on power. Alibaba and Tencent invested in hundreds of startups over the years, often helping shape entire segments of the consumer internet from ride-hailing to grocery delivery.

Alibaba’s restructuring marks a departure from the internet company’s traditional preference for keeping most of its operations under one roof, running everything from supermarkets to datacenters under the main Alibaba umbrella. Decentralizing the company’s business lines and decision-making power addresses one of Beijing’s primary goals during its sweeping crackdown. Another key priority is jumpstarting growth after years of Covid Zero restrictions depressed activity across the world’s No. 2 economy.

“For Beijing, it addresses the concern over the abuse of monopolistic power by internet behemoths,” Evercore ISI analysts Neo Wang and Gin Wang wrote. “The split-up could also serve as a template for Alibaba’s peers, but we don’t expect any imminent similar move.”

Read more: Splitting Up an Empire: Here Are Alibaba’s Six Main Businesses

Alibaba’s announcement Tuesday coincided with the return of its billionaire co-founder Jack Ma to China after more than a year abroad. The timing spurred speculation that the government was finally taking the shackles off one of the country’s best-known corporate names — before unfettering other corners of the private sector to try and rejuvenate a country shattered by years of punishing pandemic restrictions.

It’s also a strong signal that Alibaba is ready to tap investors and public markets, after the Xi Jinping administration’s clampdown on internet spheres wiped out more than $500 billion of its value. Tuesday’s overhaul frees up Alibaba’s main divisions from e-commerce and media to the cloud to operate with far more autonomy, laying the foundation for future spinoffs and market debuts.

Spreads on Alibaba’s dollar bonds tightened about 1 to 5 basis points, Wednesday morning, according to credit traders, a marginal gain given the company’s already strong credit rating. Morgan Stanley estimates the Alibaba group could now collectively be worth as much as $530 billion.

“Beijing didn’t break up any business line of Alibaba, meaning ‘baby Alibabas’ still maintain their market share in respective areas, including monopolistic power in online retail,” the Evercore analysts wrote.

Beyond domestic politics, bankers and investors applauded the move. Corporate splits often generate value for shareholders by focusing attention on lucrative businesses hived off from the parent, or can improve parts of the company by sidelining loss-making divisions. Bernstein analysts including Robin Zhu said Alibaba’s business units could be worth much more than the company as a whole. They estimate that Alibaba’s shares could be worth as much as $164 each under a sum of the parts analysis, compared with a closing price of $86.12 before the announcement.

“Alibaba is telling the market that it is missing something,” said Jonathan Pines, lead portfolio manager for Asia ex-Japan at Federated Hermes. “The reason why the stock price rallied is both because there is indeed value there, but just as much because the company is signaling that it wants that value to be recognized — that it is on the side of shareholders.”

Of the six new divisions, the burgeoning cloud business attracted outsized investor attention. Group Chief Executive Officer Daniel Zhang will head up Alibaba’s cloud intelligence division, a nod to the growing role that artificial intelligence will play in the e-commerce leader’s portfolio in the long run.

The business, known within China as Aliyun, houses its Slack-like Dingtalk app and provides cloud computing and data-processing services worldwide. Born out of the need for computing power to support Alibaba’s massive e-commerce operation, it leads Asia ahead of rivals such as Amazon Web Services and Microsoft Corp.’s Azure, according to its website.

The division had consistently been Alibaba’s fastest-growing, and now also leads its effort to develop technology such as the generative AI services that have taken the industry by storm since the November introduction of OpenAI’s ChatGPT.

“There are parts that the regulator is more keen to see develop than others. Cloud for instance is likely the first to get public funding, while some others that do not help the digitalization of the economy get lower priority,” said Yang Wei, a fund manager with Longwin Investment Management Co.

Read more: Baidu’s Market Roller Coaster Shows What’s Riding on Its Chatbot

Analysts also singled out Cainiao — the logistics business that underpins Alibaba’s online commerce operations — as well as the on-demand services unit that houses gig economy operations such as the Ele.me meal delivery arm that competes with bigger rival Meituan.

“Especially for the cloud and Cainiao businesses, both of which have showed their ability to generate profit, they will more likely pursue independent IPOs,” said Shawn Yang, Managing Director at Blue Lotus Capital Advisors.

Alibaba has had previous success with spinoffs. It hived off Alipay in 2010, an unpopular move at the time that nonetheless led to the creation of Ant Group Co. The fintech affiliate controlled by Ma was on the verge of pulling off the world’s largest IPO before Beijing pulled the plug, and has said it would consider a second run at the market.

Some analysts speculated that Alibaba’s move might pave the way for its giant fintech affiliate to follow, although the two companies operate independently and autonomously.

“I guess that the warm tailwind from the policy front continues to blow,” said Xiadong Bao, fund manager at Edmond de Rothschild Asset Management. “Together with yesterday’s headline of Jack Ma and today’s news on private sector entrepreneurs, these changes of perception should help the market to confirm that China is refocused on growth.”

--With assistance from April Ma, Charlotte Yang, Vlad Savov and Jeanny Yu.

(Updates with share and bond action, analysts’ valuations from the third paragraph)

©2023 Bloomberg L.P.