Aug 10, 2021

A US$30B takeover target can have cake, eat it too

, Bloomberg News

CP Rail offers new bid to buy Kansas City Southern

Wanted: A crystal ball. Rush shipping to Kansas City Southern shareholders.

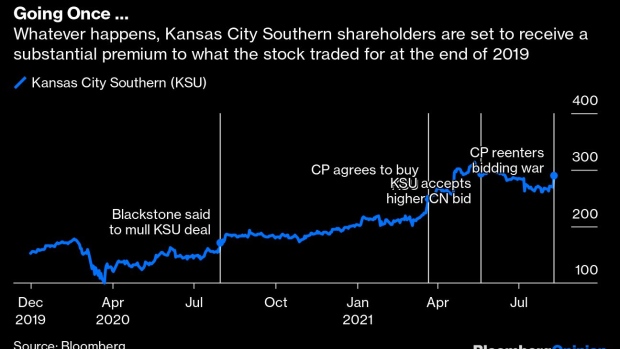

Canadian Pacific Railway Ltd. on Tuesday reentered the bidding war for the railroad, which is the smallest of the major North American rail operators and the only remaining opportunity for consolidation in an already tight-knit industry. Canadian Pacific boosted its offer to US$300 a share in stock and cash, or about US$31 billion including the assumption of debt. That’s still less than the implied current value of the deal Kansas City Southern agreed to with Canadian National Railway Co. in May. But Canadian Pacific CEO Keith Creel calls the extra dollars in Canadian National’s bid “fools’ gold” because the rival bidder faces a tougher path to regulatory approval. He’s betting Kansas City Southern shareholders will be willing to trade a higher price for more certainty that a deal will actually close. The trouble is, while it’s clear that Canadian National has to jump through more hoops to win regulators’ signoff and there are reasons to be skeptical, there’s still a chance it could pass muster.

The Kansas City Southern takeover battle is the first major railroad consolidation proposal to officially stand before the Surface Transportation Board since the 1990s. After a rash of dealmaking in the sector, the regulator adopted tougher merger rules in 2001 that require would-be acquirers to prove that a transaction will serve the public interest and enhance, rather than simply preserve, competition. Kansas City Southern was granted an exemption from that rule, however, because of its comparatively small size.

The STB has said that the exemption holds if Canadian Pacific is the acquirer and has already signed off on its proposal to use an arcane structure called a voting trust to close the deal on a financial basis for shareholders ahead of formal regulatory approval. But because there is some overlap between Kansas City Southern and Canadian National’s tracks, the STB has said Canadian National must meet the higher burden of proof under the 2001 rules. The STB hasn’t indicated whether Canadian National’s own proposal to use a voting trust meets those stricter standards. The regulator said Tuesday afternoon that it would make a decision no later than Aug. 31.

This is all coming to a head now because Kansas City Southern has asked its shareholders to vote on the Canadian National deal on Aug. 19. If investors do back the purchase, they won’t be able to consider any alternatives until February, regardless of the outcome of the STB review, according to Canadian Pacific. The counterbidder has also filed a proxy statement asking Kansas City Southern shareholders to vote against the Canadian National deal. But Institutional Shareholder Services Inc. last week advised Kansas City Southern investors to back the Canadian National deal in part because Canadian Pacific hadn’t provided “any actionable alternative.” The sweetened offer disclosed by Canadian Pacific on Tuesday does provide an alternative. Whether it’s really actionable is a different question.

If Kansas City Southern’s investor vote on the Canadian National deal goes ahead as planned on Aug. 19 and the STB hasn’t provided any updates on its perspective, shareholders will essentially have to guess at the eventual outcome. In the absence of an actual crystal ball, the best move may be to sit tight, stick with the higher Canadian National offer and see what happens. February isn’t eons away; it’s six months. Canadian Pacific clearly wants this deal badly; in addition to the sweetened price, the railroad offered to refund the US$700 million breakup fee it received when Kansas City Southern dumped it for Canadian National and front the cost of the US$700 million penalty the target would owe Canadian National if it walks away from that deal. There aren’t any alternative takeover targets for Canadian Pacific.

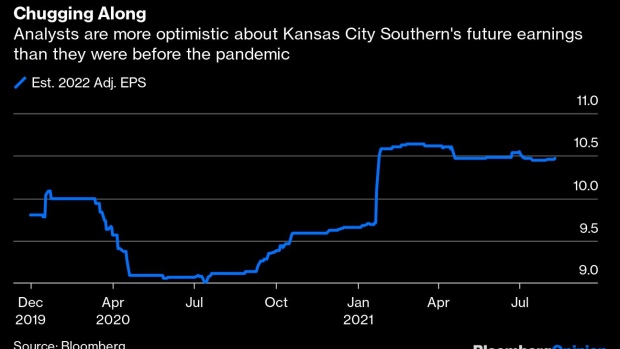

“There’s no certainty in February of 2022 that I’ll get a chance to make that compelling offer again,” Canadian Pacific’s Creel said on a call Tuesday to discuss the railroad’s latest bid. “A lot could happen between now and then.” That is true; it’s still a pandemic after all. But something would have to go wildly wrong with Canadian Pacific’s balance sheet, Kansas City Southern’s business or the financial markets for the deal to no longer make sense on these terms. And lest investors forget, this whole takeover saga first started because private equity firms Blackstone Group Inc. and Global Infrastructure Partners made several offers for Kansas City Southern last year. Someone is going to buy Kansas City Southern at the end of this.

Canadian Pacific’s higher bid seems intended to force Kansas City Southern shareholders to make a choice. Instead, it may have signaled that investors can both have their cake and eat it, too.