Apr 25, 2024

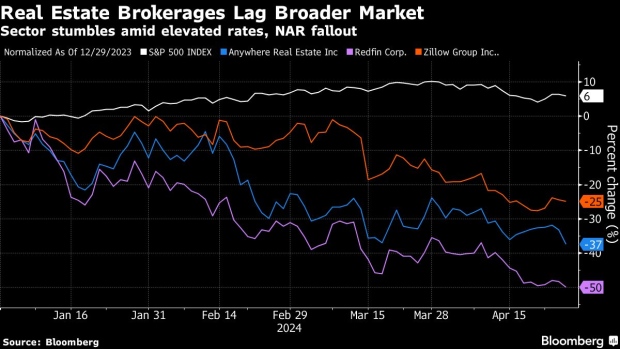

Real Estate Stocks Sink on Rate Outlook, Disappointing Earnings

, Bloomberg News

(Bloomberg) -- Real estate brokerage stocks tumbled Thursday on waning expectations for Federal Reserve interest-rate cuts, and as a disappointing earnings release raised concern about the sector’s outlook.

Shares of Anywhere Real Estate Inc. sank 7%, and are now down 38% this year, after the real estate services company reported first-quarter results that were weaker than consensus estimates. Industry peers including Opendoor Technologies Inc. and Redfin Corp. dropped as well.

Real estate was among the day’s weakest sectors in the S&P 500 Index after data showed the economy slowed last quarter while inflation jumped. Treasury yields surged to the highest levels this year, signaling that homebuyers aren’t about to get a reprieve from elevated borrowing costs.

While analyst said that Anywhere’s results showed a return to overall transaction growth for the first time two years, investors were more fixated on the firm’s misses when it came to earnings and revenue. It helps set the tone for a slew of announcements ahead: Peers including Zillow Group Inc. and Opendoor are slated to report in the coming weeks.

“It’s less about what they print this quarter and more about how they talk about the future,” John Campbell, an analyst at Stephens Inc., said of real estate brokerages this earnings season.

Analysts are bearish on Anywhere’s stock, with none calling it a buy, three saying hold and three recommending to sell, data compiled by Bloomberg show.

On top of high borrowing costs, there’s another force weighing on the sector: questions around commission rates after the National Association of Realtors got preliminary approval for its $418 million settlement with home sellers over commission rules for real estate agents.

The industry is also seeing a bifurcation between traditional and technology-centered brokers, according to Campbell. Digital real estate players like Zillow are gaining market share, positioning them to outperform.

©2024 Bloomberg L.P.